Crypto bull runs are like wild parties. Prices go up, excitement goes higher, and everyone wants in. But if you want to make the most of it, you’ve got to be smart. A bull run can boost your portfolio, but it can also trick you if you’re not careful.

TLDR: A crypto bull run is when prices shoot up fast. It’s your chance to maximize gains, but it’s important to stay calm and plan ahead. Take profits, don’t chase pumps, and always manage your risks smartly. Use simple strategies, and don’t let FOMO ruin your gains.

1. Have a Plan Before It Starts

Don’t wait until prices are flying to figure out what to do. The work starts way earlier.

- Set goals: Decide when you’ll take profits or buy more.

- Choose your coins: Focus on projects you understand and believe in.

- Know your risk: Only invest what you can afford to lose.

Pro tip: Write your plan down! It’s easy to forget when emotions take over.

2. Don’t Get Caught in FOMO

FOMO (Fear Of Missing Out) is the number one profit killer. Everyone on social media is hyped. Some coin just 10x’d, and you want in. That’s when people make mistakes.

What to do instead:

- Stick to your plan. Don’t chase candles.

- Be patient. New opportunities will come.

- If you missed a pump, look for the next setup.

3. Take Profits on the Way Up

This is huge. In a bull market, it’s tempting to never sell. You think it’ll just keep going. Until it doesn’t.

Smart strategy: Take profits in small amounts.

- Sell a bit every time a target is hit.

- Use percentages – maybe sell 10% every 50% gain.

- Move profits into stablecoins or safe assets.

Remember: No one ever went broke taking profits!

4. Use Stop-Loss Orders – Yes, Even in a Bull Market

This might sound weird when prices are shooting up. But markets can turn fast. A stop-loss protects your money if things reverse suddenly.

Try this:

- Set stop-loss just below important support levels.

- Adjust as the price moves higher (“trailing stop-loss”).

Think of it like a safety net while you’re walking the tightrope of gains.

5. Avoid Meme Coins (Unless You’re Playing for Fun)

Meme coins like Doge and Shiba may explode. But they can crash just as hard—faster, even.

If you do invest:

- Only use money you’re totally OK losing.

- Set aggressive profit targets. Get in, get out.

- Don’t try to time the top. Very few people do.

Meme coins are for entertainment. Treat them like lottery tickets, not investments.

6. Know When to Exit

Every bull run has an end. And when it ends, it’s usually sharp and painful. If you’re not careful, you’ll watch your gains disappear.

Watch for signs:

- Massive spikes in new users or media coverage

- Everyone you know suddenly wants to buy crypto

- Prices growing faster than usual, with weak fundamentals

These moments feel exciting—but they can be a warning sign.

7. Diversify Your Portfolio

Don’t put all your eggs in one coin. Some projects dump even in a bull market. Spreading your bets reduces your risk.

Consider a mix of:

- Large caps: BTC, ETH

- Mid caps: Established altcoins with strong use cases

- Smaller caps: Higher risk, higher reward tokens (but research them!)

Diversification helps you win even if one or two bets go bad.

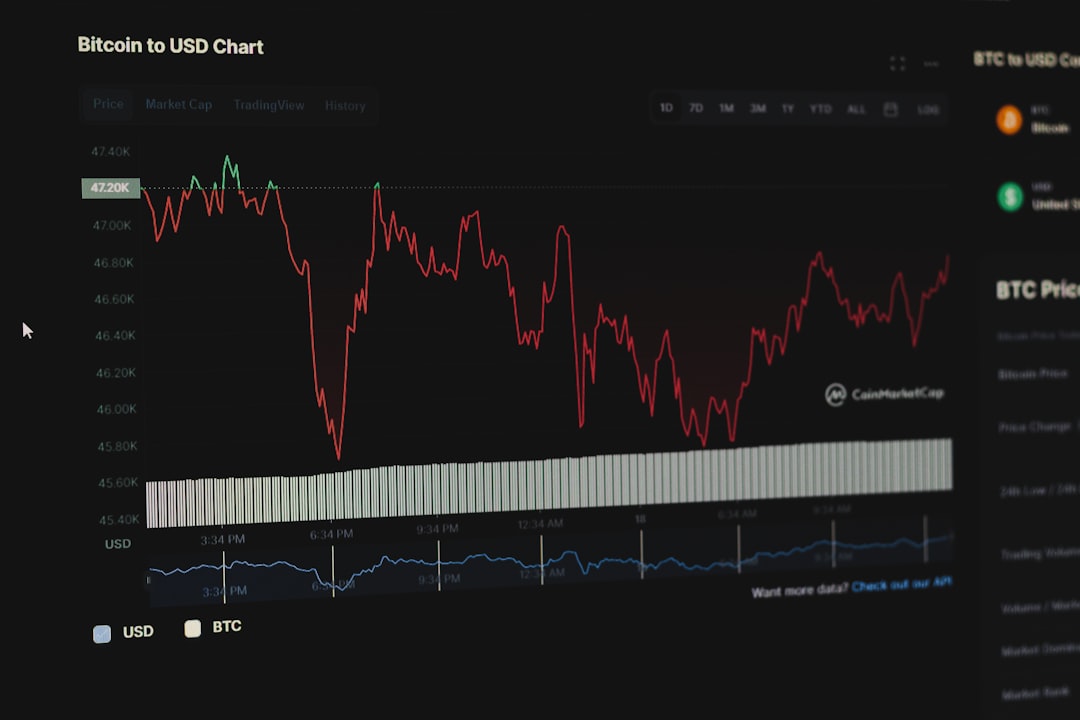

8. Watch Bitcoin – It Sets the Tone

Crypto runs on Bitcoin energy. If BTC pumps, altcoins usually follow. If BTC crashes, so does everything else.

Keep an eye on:

- BTC dominance (if dominance goes down, altcoins usually rise)

- Major news around BTC

- Chart trends and resistance zones

Understanding Bitcoin’s movement gives you clues about what’s next.

9. Get in Early (But Only on Projects You Believe In)

Early birds don’t just get worms—they get 10x bags. But early entries come with risk.

If you go early:

- Study the whitepaper and roadmap

- Look at the team and partnerships

- Only use what you can afford to lose

Don’t buy just because someone on Reddit said it’s the “next big thing.”

10. Don’t Forget Taxes

This one’s boring, but important. When you make gains, the taxman wants his share. Don’t be caught off guard.

Some tips:

- Use crypto tax tools to track your trades

- Know your local crypto tax rules

- Set aside a portion of profits for tax season

Earning money is great. Keeping it is even better.

11. Stay Updated, But Filter the Noise

News and influencers can move markets—especially in bull runs. But there’s a lot of hype and bad advice out there.

Stick to:

- Official project updates

- Reliable news sources

- Crypto communities with smart discussion

Always DYOR (Do Your Own Research).

12. Psychology is Everything

When your coin is up 300%, your brain will scream “HOLD FOREVER!” But markets don’t work like that. Bull runs end. Emotional decisions ruin gains.

Remind yourself:

- This is not your last chance to make money

- Winning means walking away with profits

- Stick to your plan even when it’s hard

The best traders are calm and disciplined—even during hype.

Final Thoughts

A crypto bull run is your chance to win big. But only if you’re smart. Have a plan. Take profits. Don’t get greedy. Be like a surfer—ride the wave, but know when to get off.

Keep learning, stay calm, and remember—no one ever regretted locking in profits.

yehiweb

Related posts

New Articles

How to Generate Intermediate Representation for a Compiler: 5 Essential Steps Used in Modern Compiler Design

Modern compilers are sophisticated systems that transform human-readable source code into efficient machine code. At the heart of this transformation…