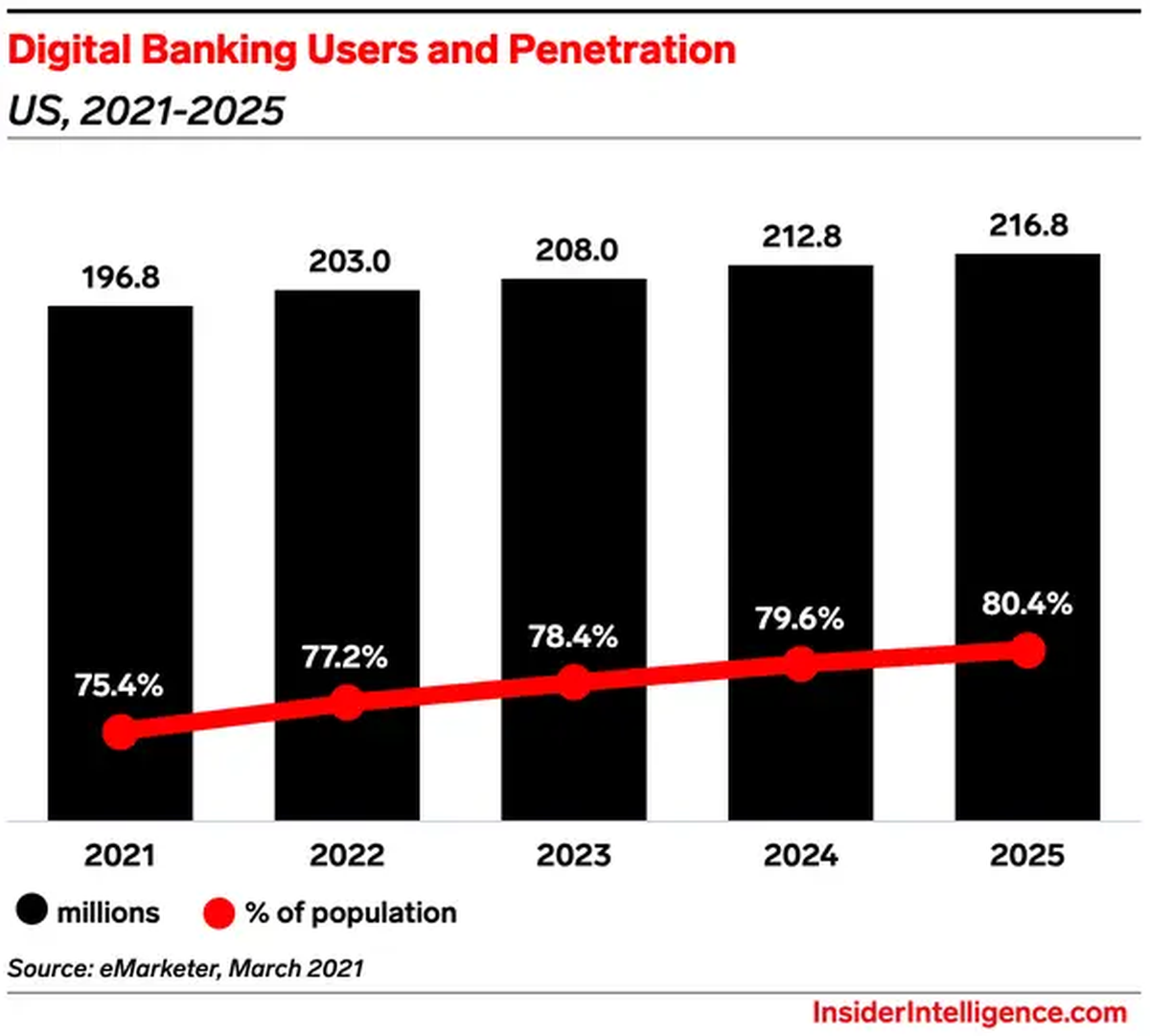

With high-speed internet available virtually anywhere nowadays, it’s no surprise that a vast majority of all bank transactions are done online. Because of this, there’s a much bigger emphasis on all aspects of internet banking, including security.

Since we’re talking about money, it’s only natural people are overly cautious, and rightly so – we can read about examples of breach issues. The first thought that usually comes to mind is, “I hope it never happens to me.”.

Aside from the banks which have their security measures in place, there are also things you can do to elevate your security level.

How does online banking function?

The first step in securing your personal data and, equally importantly, your money is to know how exactly the whole process works. We’re not talking about an in-depth behind-the-scenes guide, but more of one introducing you to the general sense of things.

To put it short, online banking can replace almost every reason for a visit to the bank in person like:

- Transactions (withdrawals, deposits, transfers, etc.) – might be limited to a max amount

- Loans – basic loans can usually be done through an app

- Checking your account balance

- Applying for credit cards

How Do You Benefit From Online Banking?

The upsurge in online banking benefits both banks and customers because everything can be done quicker and more comfortably. The bank also usually lowers the cost per transaction than with an in-person visit.

As you would expect, some of the main benefits of online banking share the same benefits as other online services. The most prominent ones are:

- Convenience – you’re in a cab on your way to work, thinking about your accounts at ten o’clock at night or jogging at 6 AM, and you can still access everything with just a couple of clicks.

- Speed – basically, everything you can do through online banking is faster than its in-person counterpart.

- Availability – you’re able to access all your data 24/7 (short maintenance times excluded) and perform all the aforementioned actions any time you like.

What Are the Potential Security Risks to Online Banking?

Because security is such a big part of financial transactions, it’s very good to know that, overall, online banking is considered to be a very secure method of doing business. Another thing worth mentioning is that users of the service are aware of how important it is, which quickly leads to the conclusion that they should follow the recommendations experts put out.

That being said, there are threats that could prove troublesome and cause issues, big or small. Let’s find out what some of the most common threats are.

Malware

When people refer to “viruses”, they mostly think of malware. The term malware is used for all malicious software that can plague your digital device. Among other things, malware encompasses:

- Spyware – works in the background and enables the hacker to see everything you do on the screen.

- Keylogger – records everything you type, targeting sensitive information like login passwords.

- Virus – usually takes over your computer entirely, gaining access to everything stored within

- Ransomware – takes your digital device “hostage” and blackmails you into handing over funds unless you want your personal detail to be leaked online.

Phishing

The best way to describe a phishing scam is to recall the famous case of the Nigerian prince exiled from his country, who needs a little bit of your money in order to get back in power and reward you handsomely.

While this approach is laughable now, phishing scams have become much more sophisticated, recently mimicking messages from your subscription service, work, or even bank. Because of this, they still tend to generate considerable income for those that use them.

Fraudsters also use phishing to steal your personal information. With this data, they can then apply for credit cards or even loans in your name. To prevent identity theft, you have to be very careful where you enter data like your SSN or bank account details. And phishers are becoming ever more inventive.

They’ve even branched out from mail and now target instant messaging services like Viber or WhatsApp and don’t g directly for your money, but also tend to provide fake forms so that they can obtain your sensitive data.

Third-party associations

Banks will sometimes employ third-party companies to elevate their services with features often too costly or time-consuming to implement themselves. It’s imperative that these associates employ the same level of security measures so your data isn’t compromised when redirected.

While this security risk isn’t a direct attack by any means, it still represents a potential weak link in the chain that can be targeted for easy access. The risk is further elevated if the user doesn’t even know where they’re being redirected to and the level of security used at the new location. If anything seems suspicious, be sure to notify your bank immediately.

How to Maximize the Security of Your Online Banking?

- Use strong passwords – this one should be rather self-explanatory; you can’t use passwords like 1234 anymore, and you should stay clear of names and birthdays as well. It’s very important to use both lower and upper case letters along with numbers and symbols. A good trick is to use a complete phrase that you can easily remember (without spaces, of course).

- Set up alerts – all online banking apps have alerts automatically turned on once they’ve been set up, so this shouldn’t require any actions on your part. Whenever your cards are activated or your account has been accessed, you’ll get a notification/alert. These alerts are most commonly push notifications or SMS messages. Either way, always check what they say before dismissing them.

- Use two-factor authentication – two-factor authentication is becoming a mainstay not just for internet banking but everywhere where you need to log in with your username and password. The principle behind it is that aside from your password, you need to enter a one-time code sent via message to your phone (in most cases) to confirm your identity. It’s hard for a hacker to get both, so your data is much safer than with just one identification method.

- Use a VPN – you should avoid using public Wi-Fi for online banking altogether, but if you can’t, using a VPN secures your data by accessing a virtual private network that is only accessible to you. Even if you’re using your personal network, a VPN provides a welcomed extra layer of security, especially regarding all types of malware attacks.

- Use a digital wallet – using a digital wallet is safer than paying with a card because the app generates one-time codes that expire after use, opposed to PIN numbers that remain the same. Even if someone were to gain knowledge of your code, it’s quickly gone, meaning your data is still safe.

Conclusion

Online banking security is a priority for every service provider, and they take their responsibilities very seriously. Having said that, there are always a few things you can do on your end to elevate that security even further.

Granted, nothing is foolproof, but with just a couple of steps, your accounts could come close to it. Find the time to engage yourself for even a little bit, and you’ll never have to worry about an attack regardless of the form it comes in.

Matej Milohnoja

Related posts

New Articles

Top 9 Small‑Scale Time‑Tracking & Session Logging Tools That Freelancers Use to Accurately Bill Clients Without Overkill

Getting paid right is hard work—especially when you’re freelancing. Clients want to see hours. You want to show you’ve really…