Accounting software is the best place to begin if you are looking for tools to make your accounting process more efficient. These are some suggestions of what you should be looking for. Small business owners can find a lot of apps that help them manage their businesses. Apps are available for invoicing, time tracking, bill payment, employee pay, etc.

Small business owners, especially those with multiple jobs, might be better off looking for accounting software that does most of the work.

Apps are great for performing specific functions that your current software doesn’t. However, using only applications can complicate the situation and cause a lot of work, which you probably don’t have the time or resources to do.

A good accounting tool will allow you to spend more time working on your company and less on basic bookkeeping.

What are accounting tools?

Even if your skills are not technical, accounting tools can be used to handle mundane tasks that normally take a lot of time. Accounting tools are excellent for:

- Recognizing expenses

- Producing financial reports

- Auditing and reviewing records

- Calculating tax

- Collaboration with your accounting team

They will automate your accounting tasks and reduce errors. You can even save money.

Research also shows that companies that do their financial reports weekly or monthly have a lower success rate than those using automated accounting software. Statista research shows that 64% of businesses use accounting technology.

The technology that handles various financial and accounting processes is commonly referred to as Accounts payable automation (i.e. AP automation — one infographic shows how AP automation systems could save you at most 16$ per invoice.

Top 5 accounting tools you can find online for your business 2022

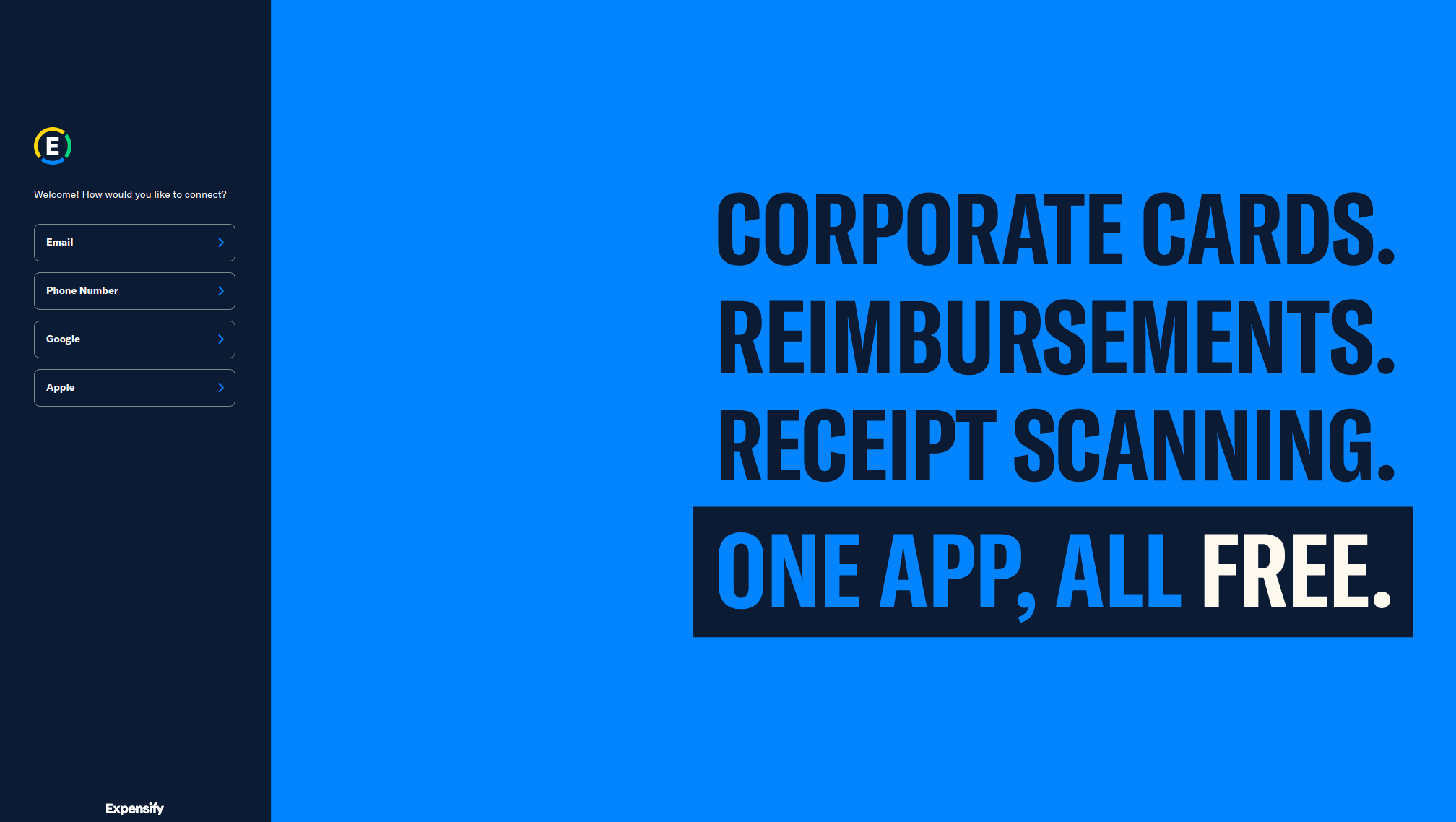

1. Expensify

This is Expensify’s motto, and it’s great! While recording expenses may not be a high-priority task on your list of important tasks, it can take time and energy.

What if the process could be automated?

Expensify aims at doing just that. You can take photos of receipts and convert them into Expensify codes or reports. All you have to do is hit “Approve” to set your company policies so that you approve certain expenses, and others are automatically filed.

With their automatic rapid reimbursement system, Expensify will reimburse your employees’ expenses within the same day. Any changes to your accounting system will also be reflected in Expensify.

This accounting tool is simple and intuitive for employees. Business owners can use it to speed up the process of managing expenses.

2. Neat

Similar to Expensify allows you to scan receipts or financial documents. However, Neat does not allow you to use a smartphone. Access your files securely from anywhere and on any device.

Neat integrates with other accounting tools to easily transfer expense documents to create expense reports, track bills and share financial data with co-owners or your accountant. You can now do your expense filing online without the tedious, slow and laborious process of manually entering.

What is it that sets Neat apart?

Neat allows you to easily add contact information and sync these contacts with your email marketing platform. You can choose the contact list to which each contact is added, and voila! Instantly bring live customers into digital marketing campaigns. You can snap a picture of their business card, and you are good to go.

3. FreshBooks

FreshBooks is the best online accounting and bookkeeping program for those just starting. It’s especially suitable for contractors and sole proprietors. FreshBooks has a Teams version if you need to add contractors or employees.

FreshBooks is designed for the non-accountant. It guides you step-by-step through every accounting process from the very first time. Thanks to its Retainers option, it is especially well-suited for solo lawyers, accountants, and other self-employed professionals.

FreshBooks has excellent invoicing capabilities. FreshBooks allows you to snap a picture of receipts and upload them to FreshBooks for better expense reporting.

You can also connect your bank accounts to the application, which allows you to manage client projects, track time, and make payments.

FreshBooks allows you to create job estimates and formal propositions. FreshBooks Payments also lets you accept online customer payments. Although there are not many reporting options in FreshBooks, you can access the financial statements.

FreshBooks offers many benefits, including phone support. FreshBooks is also very easy to set up and use, making it great for those who don’t have an accounting background.

FreshBooks currently offers four plans. Lite is $15/month, Plus is $25/month, Premium is $50/month, and Select is $50/month. Pricing is available from FreshBooks upon request.

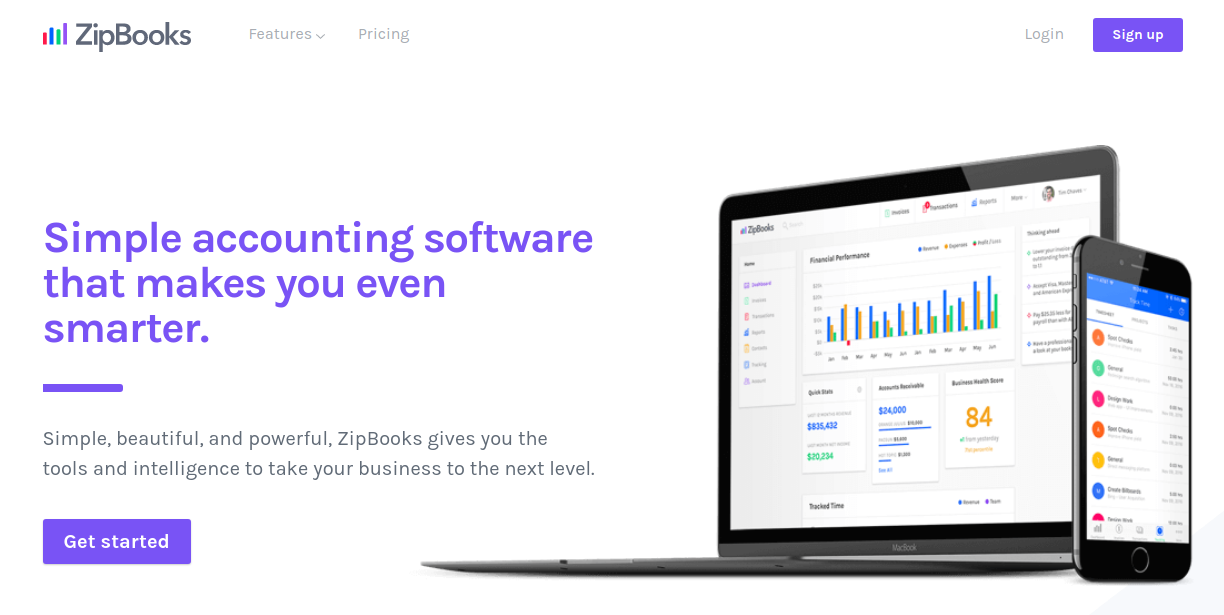

4. ZipBooks benefits

ZipBooks allows you

- Manage your tax affairs with ease

- Each project will have its accounting task.

- Keep track of your expenses

- Invoice processing

- Keep track of receipts and

- Secure partial payments

ZipBooks’ Intelligence system is the best feature. You will get insights and reports highlighting profitable customers and comparing you to your competition.

Available for Web, Mac, iOS, and Google Chrome

Market: the United States and Canada

Conclusion

Wave’s payment gateway is where it makes its money. Wave charges 2.9% plus 30C/per transaction for Visa, Mastercard, and Discover and 3.4% plus $30C/per transaction for American Express. These fees are slightly more than those charged by other accounting software. Wave charges 1% per transaction to process ACH payments instead of credit cards and a $1 minimum fee. Wave is the only accounting software that charges a fee to process ACH payments.

Related posts

New Articles

What is the difference between FMWhatsApp and GBWhatsApp?

In the world of messaging apps, WhatsApp reigns supreme as one of the most popular platforms for connecting with friends…